Last week Christy shared how she manages their household finances and today it is my turn. I think this is an interesting blog topic, as it is something that pretty much all of us have to deal with each and every month. I also don’t think we’ve ever talked about it in a dedicated blog post and after all these years, and goodness we’ve talked about just about everything!

I know every home is different, but my husband has zero interest in managing our $ so I handle this chore for us. It fits in with my need for order and organization, and after all these years I have a strategy that is easy and works well for us. I pretty much do things in a similar way to Christy does things with one exception. I’d venture that because my husband is in sales (and I am self-employed) we have to manage our money a little differently since the amount of income we have coming in each month varies. So for those of you who own a business or have similar commission based-income I’ll try to share some tips.

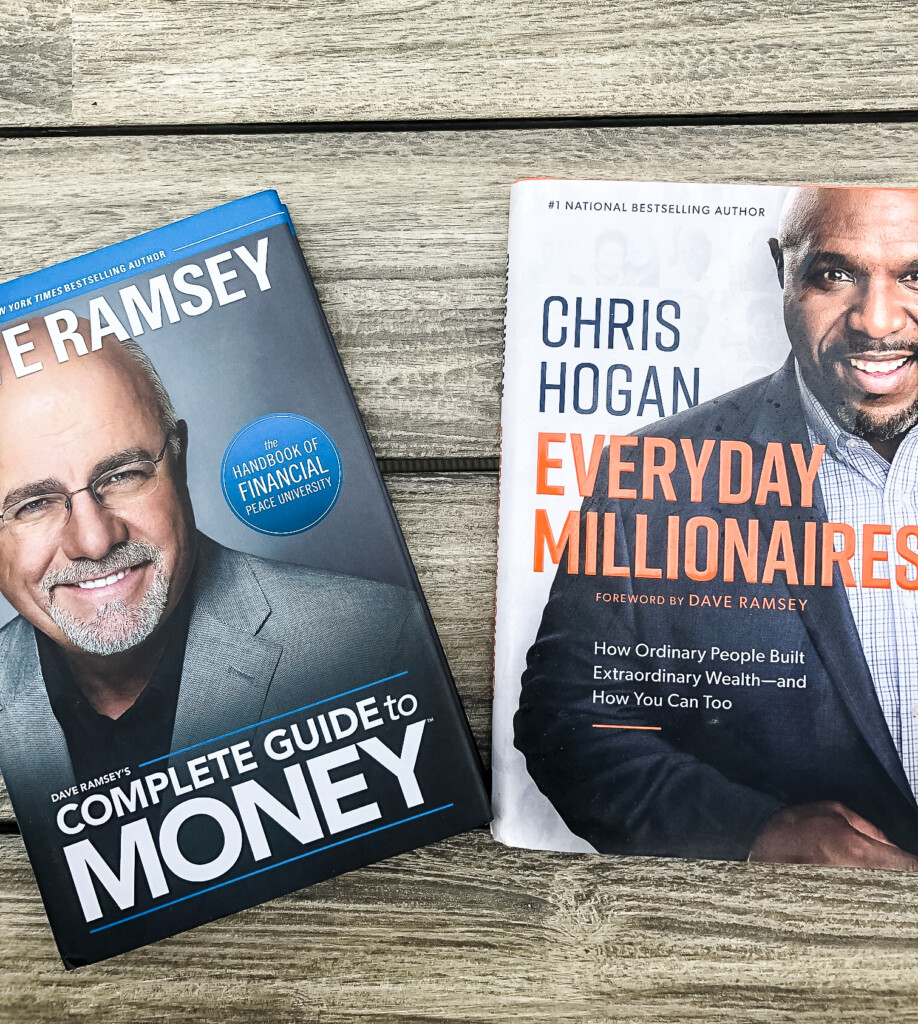

I also whole-heartedly agree with following Dave Ramsey’s steps (or even better take a class, you can find one at a local church) this is especially useful if you are young or newly married. One of my new year’s resolutions this year was to spiff up our financial management and I actually reread his book for a refresher. Those of you already familiar with his methodology I also highly recommend Chris Hogan’s books, he works with Dave Ramsey and is the retirement guru, among other topics, so this is kind of the next level of their methodology. I whizzed through several of his books earlier this spring.

We are fortunate on many levels, and one of the most important things I have learned over the years about financial management is first and foremost, the importance of giving. It comes down with trusting God with your money and to provide. We donate to our church (tithe) and also support a child each month through Compassion International and an orphan at The Mission in Tijuana, Mexico where my oldest son has volunteered the last two summers. I share this not in any way to glorify what we’re doing but just to say we try to approach our money management believing “to much is given much is expected” and have certainly found the adage “the more you give the more you receive” to be so very true.

photo via Susan Seidel Photography

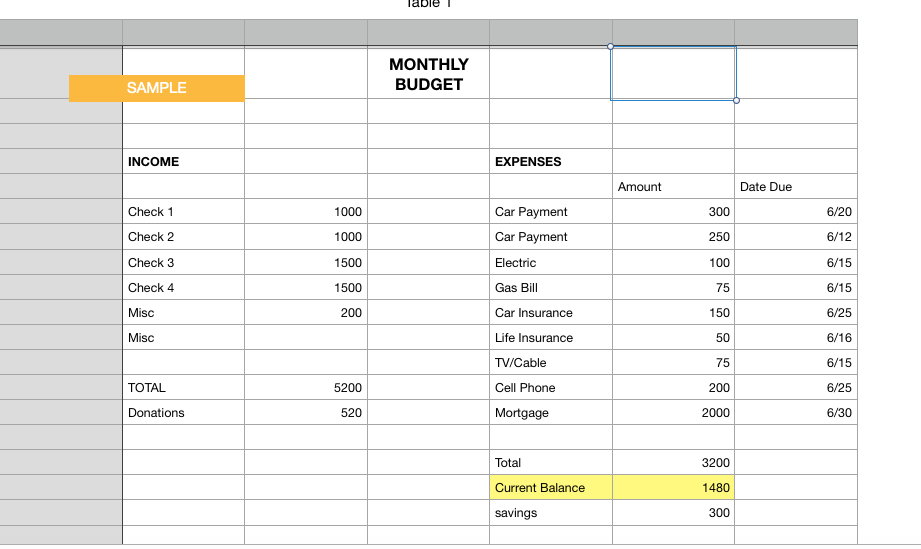

OK, practically speaking after all these years I think our family money management system is fairly simple. Being someone who likes spreadsheets, when we first were married (and I had extra time at a rather boring desk job) I created a monthly spreadsheet to help us budget, pay off debt and save money. I still use the same system all these years later. You can put something like this together in a matter of minutes if you have familiarity with Excel or Numbers, it makes life so easy.

Below is a SAMPLE spreadsheet I quickly created to show you how ours works.

I periodically go through and drop in the amounts of bills, the income we have or know we are projected to receive, and then spend a few minutes allocating our $ ahead of time. This is especially helpful since at any point in the month I can then drop our bank balance in, delete anything that has cleared the bank and see exactly how much money we have left to spend. I have zero need to balance a checkbook doing this way. It takes seconds to pay bills too, I have the amounts right here when I need them.

I mentioned this year that I tried to up my game a bit this year and as my kids have gotten older I have noticed that while our incomes have thankfully risen, so have our expenses–tremendously! So I wanted to do a better job figuring out where our money was going so in January I downloaded Quicken on my computer. It’s fairly easy to use, and while it does way more than I need it to, now I can go in and categorize any expenses that it doesn’t recognize and get a quick look at how much we’ve spent on groceries or restaurants (pretty much where all my money goes having teenage boys!) or any other category. This will also save me a ton of time come tax season as it tracks our charitable donations as well as all my business expenses.

I am not as on the ball as Christy in scanning things in, so I probably have way too much paper stored up. I could do better with not saving everything but right now after I pay a bill (like a medical bill), I write the date I paid it on it and file it in the accordion file (shown on the bottom shelf below, this is similar). I got this file at Target several years ago. It is divided into sections, I labeled each section with all our bills like utilities, retirement, medical, mortage, insurance, automobiles, investments, taxes…you get the picture, and then I just stick the receipts or bills in it about once a month. I basically let everything pile up in this all year then in early January I take everything out, pop them in labeled envelopes and store it all a bankers box in my basement marked with the year. After the allotted time has passed and I don’t need the receipts etc for taxes, I shred everything in the oldest box and reuse the box for the current year.

I think that covers our system, it has worked for us for years. Do you all have any good tricks to stay on top of your money?

XO,

We promise to never sell your email information. Our posts contain affiliate links. If you make a purchase after clicking on these links, we will earn a small commission, which helps to keep our content free. You don’t pay a cent more than you would otherwise, since that would be tacky! Please see our full disclosure policy here.